the tax shelter aspect of a real estate syndicate

552 The tax shelter aspect of a real estate syndicate. As such AB Co.

Podcast Defining Your Tax Strategy

Here are some of the top tax benefits of investing in a real estate syndication or fund.

. Tax Strategies for Real Estate Investors with Ted Lanzaro. Is strengthened by the Tax Reform Act of 1986. 19 As one might expect the term includes a partnership or other entity if a significant purpose is the avoidance or evasion of federal income tax.

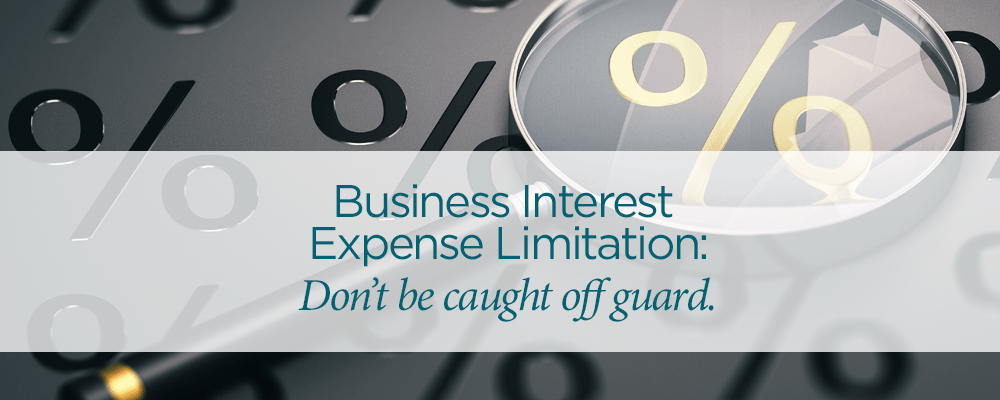

461 because more than 35 of the loss will be allocated to B who is considered a limited entrepreneur. Ners to shelter income from the syndicate or from other sources4. An exception to the general rule that small businesses are exempt from the 163 j limits on the deduction for business interest applies to any entity that is a tax shelter.

Investors were deducting tax losses on non-recourse debt in other words taking. However the broader definition of small business is a surprise to many. I am not a CPA please consult a tax professional for your particular situation.

A tax shelter includes any entity plan or arrangement where a significant purpose of the entity plan or arrangement is the avoidance or evasion of federal income tax. Individuals are now able to claim up to 1118 million in comparison to the 529 million limit per person in 2017. Has remained unchanged since 1986.

If you carry a mortgage on your rental property you can deduct mortgage interest paid come tax time. The tax shelter aspect of real estate syndicates no longer exists. True The tax laws prevent real estate investors from taking losses in excess of the actual amounts they invest.

Is available only to doctors. Tax shelter has the meaning provided by Sec. A tax shelter also includes any enterprise other than a C corporation that has had interests offered for sale in an offering required to be registered with any federal or state regulatory agency.

In short the tax shelter aspect of real estate syndicates no longer exists. Limits taxpayers ability to use losses generated by real estate investments to offset income gained from other sources. Real Estate Syndicate Act and placed jurisdiction over small real.

Basic Securities Law and Tax Aspects of Private Limited Partnership Offerings in California 4 W. The most likely problem to arise that many may not initially notice is that the organization might meet the definition of a syndicate. A brokerdealer specializing in the syndication of real estate tax shelters and other real estate projects.

Today real estate investors must use accelerated depreciation methods to recover the costs. A syndicate is defined as a partnership or other entity excluding C corporations where more than 35 percent of the entitys losses are allocable to limited partners or limited entrepreneurs. What is the Definition of a Tax Shelter.

This is because DSTs are considered real estate properties and therefore the investors of a DST will need to file in each state where the property or properties are located. 115-97 made tax accounting easier for many businesses with average annual gross receipts of 25 million or less inflation-adjusted to 26 million for 2019 under Sec. Thus investors cannot deduct their real estate losses from income generated by wages salaries dividends and interest.

Does not receive a deduction in year 1 for its 10 of interest expense resulting in a tax loss of only 20. Any syndication with the meaning of section 1256e3B and. The Tax Cuts and Jobs Act PL.

Thanks to the recently updated tax law tax shelters have now doubly improved. Is considered a syndicate and thus a tax shelter in year 1 for purposes of Sec. The term tax shelter means.

See eg Bazos The Limited Partnership as a Vehicle for Syndicated Real Estate In-vestment. January 11 2019 by Ed Zollars CPA. It introduces the concept of a syndicate as a tax shelter.

The tax laws prevent real estate investors from taking losses in excess of the actual amounts they invest. The benefits include the cash method of accounting exemption from UNICAP rules exemption from some inventory accounting requirements and. The tax shelter aspect of real estate syndicates no longer exists.

In 2011 Michael Dell reportedly qualified his 714 million 1757-acre Texas ranch for. Will return in 2005. And theyve created huge incentives for investments in passive real estate.

Section 469 was passed to put an end to rampant use of egregious tax shelters including real estate syndicates. On January 11 2019. 461i3 including a specific rule for farming activities.

This tax exemption expires after 2025 is over so its best to take advantage while it still applies. Any enterprise other than a C-Corporation if at any time interest in such enterprise have been offered for sale in any offering required to be register with any Federal or State Agency has the authority to regulate the offering of securities for sale 2. This deduction is huge and often overlooked.

Thomas Castelli CPA is a Tax Strategist and real estate investor who helps other real estate investors keep more of their hard-earned dollars in their pockets and out of the governments. 20 In addition a tax shelter is any enterprise if interests have been offered for sale in any offering required to be registered. Selected Tax Considerations 1973 Wis.

But according to The Nation the rich are using it as a tax shelter. Another tax aspect of DSTs that investors need to be aware of is that investors will need to file taxes in every state where the DST holds property in. There wont always be significant real estate investment tax shelter benefits when you are flipping a house because odds are you sell the property within a year of purchasing but every little bit helps.

Compelling Tax Benefits Of Real Estate Syndication

Prem14a 1 Nt10018953x1 Prem14 Htm Prem14a Table

Difference Between Operating And Financial Lease Finance Lease Lease Finance

Irs Issues Guidance For Businesses That Elect Out Of Interest Expense Limitations

The Case For Private Real Estate White Coat Investor

What Is The Definition Of Tax Shelter Business Interest Expense

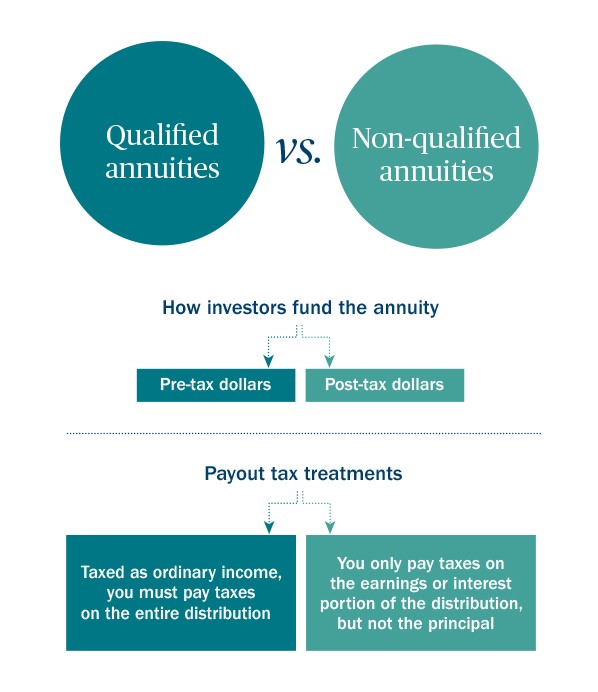

Taxation Of Annuities Ameriprise Financial

What Is The Definition Of Tax Shelter Business Interest Expense

How Physicians Can Shelter W 2 Income With Real Estate Professional Status Reps

Real Estate Syndication Tax Benefits Holdfolio

The Ultimate Spc Guide To Taxes Our Book Club Tax Free Wealth Simple Passive Cashflow

Disallowed Syndicated Conservation Easements Attorney Investigation

Real Estate Syndication Tax Benefits Holdfolio

Real Estate Syndication Tax Benefits Holdfolio

Podcasts Tax Smart Real Estate Investors Podcast

Fin 381 Ch 17 Final Exam Review Flashcards Quizlet

Difference Between Operating And Financial Lease Finance Lease Lease Finance